Medicare will cover your health costs when you reach the age of 65. Well, sort of…

As you’ve been working you’ve been paying into Medicare every month. Now when you reach retirement age Medicare will pay you back by paying for your healthcare costs.

That’s the theory, but of course Medicare was designed by the government, so it’s more complicated than that. Here’s a quick primer on Medicare choices.

We will say right upfront that you probably want to talk to an insurance agent before you finalize your plan.

The Medicare alphabet

We’re going to simplify this as much as we can so it’s clear(ish).

Below is a very simplified explanation of your Medicare options. There are many caveats in explaining Medicare options but we will forgo those for this explanation.

- Part A: Pays for your hospital stays but does not pay for doctors services. You get Part A for free from the government based on all the money you’ve paid in over the years.

- Part B: Covers doctors fees and outpatient services. Costs roughly $100-$400 per month depending on your income. Provided by the government.

- Part C: Provided by insurance companies not the government. You can elect to get Part A and Part B coverage plus more by going to a private insurance company.

- Part D: Covers prescription drugs.

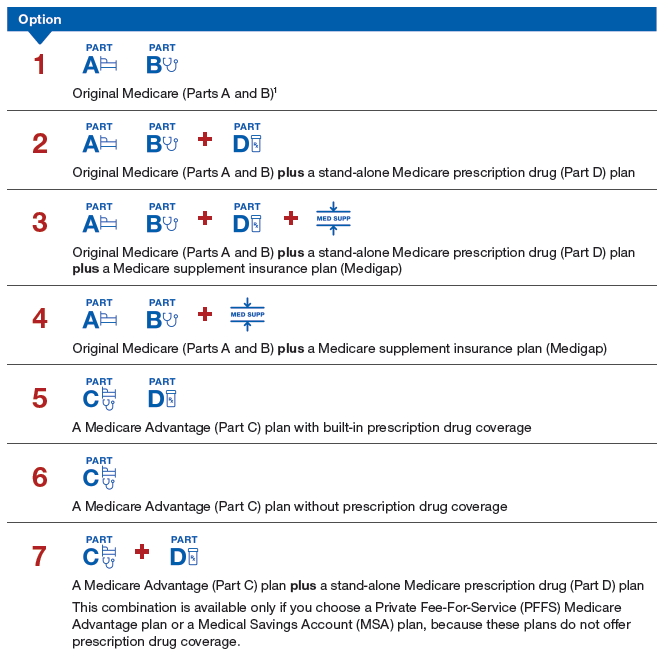

There are many coverage options. See this chart from United Healthcare for example.

Do I need additional insurance?

Part A and Part B are provided by the government (sometimes called “traditional Medicare”). Part C and Part D are provided by private insurance companies.

There is no one-size-fits-all answer to which combination of parts you need. You can even buy supplemental insurance on top of the “parts” described above.

Additional coverage may be needed if you need a lot of health care or you want insurance to cover copays (for example Part B only covers 80% of the cost of doctors services) or deductibles.

This post just scratches the surface of the choices available when selecting the best Medicare plan for you.

This is one area where speaking to an experienced advisor would surely help. John B Wright has experience in many areas of health insurance. Our knowledgeable agents can be contacted here.

Leave a Reply